History of the Fed

The Fed was created on December 23rd, 1913 in response to several financial panics that occurred in the early 20th century. The need for a centralized monetary system caused the creation of the Federal Reserve System. The primary motivation for creating the Federal Reserve System was to address banking panics. Other purposes are stated in the Federal Reserve Act, such as "to furnish an elastic currency, to afford means of re-discounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes". Before the founding of the Federal Reserve System, the United States underwent several financial crises. A particularly severe crisis in 1907 led Congress to enact the Federal Reserve Act in 1913. Today the Federal Reserve System has responsibilities in addition to ensuring the stability of the financial system.

So what does the Fed really do?

The Fed has several functions to include:

- Addressing banking panics

- Serves as the Central Bank of the United States

- Supervise and regulate banking institutions

- Protect the credit rights of consumers

- Manage the nation's money supply

- Moderate long-term interest rates

- Strengthen the US standing in the world economy

The structure of the Fed is comprised of a Board of 7 Governors who are appointed by the President of the United States, and confirmed by the Senate for 14 year terms. This board oversees 12 District Reserve Banks and sets national monetary policy. It also regulates the US banking system.

So how does the Fed affect my financial planning?

|

| https://en.wikipedia.org/wiki/Federal_Reserve_System#/media/ |

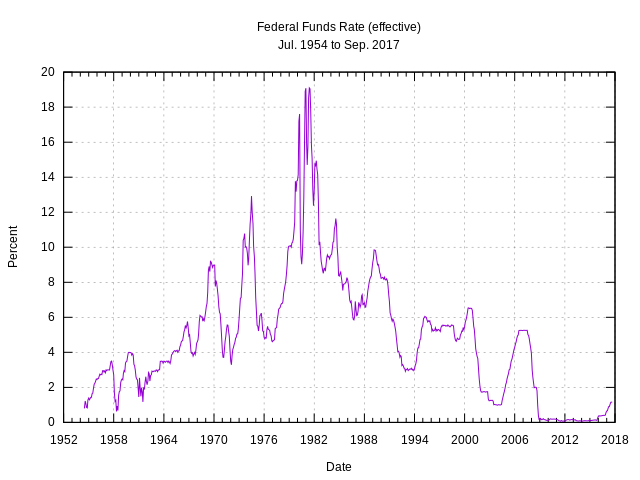

The effect of increasing or decreasing the federal funds rate has a ripple effect. In general, the lower the rate, the lower a bank can charge interest on loans such as mortgages, and credit cards. It costs less to borrow money and provides consumers with access to money to spend immediately. When consumers pay less for a house or car loan, they have more money to invest or save. Businesses can also benefit, as it allows them capitol for new equipment or hiring new employees.

If the federal funds rate is higher, then consumers won't have as much disposable income, and banks may make fewer loans. Businesses may also contract and the demand for goods and services may help to lower inflation.

It's important to keep an eye on what the Fed is doing with the federal fund rate, as it can affect your decision on where to put your investments or savings. Different financial products may be affected (either positive or negative), and your decision on where to find your highest rate of return my change.

Let Bogetto and Associates help you figure out what the Fed's effect on your financial goals may be.

Hiring a professional financial advisor firm can make a big difference in working towards achieving your financial goals. We look at what the Fed is doing and can offer you advice on what financial products may fit best for working toward achieving your goals. If you have further questions on the Fed or want to know how interest rates affect your investments or savings, please give us a call!

Sources:

Financial Health...For Now & Tomorrow

Contact us Today

Website - www.bogettoandassociates.com

Telephone - 314-858-1602

Email - peter@bogettoandassociates.com

10805 Sunset Office Drive, Ste. 202

St Louis, MO 63127

Website - www.bogettoandassociates.com

Telephone - 314-858-1602

Email - peter@bogettoandassociates.com

10805 Sunset Office Drive, Ste. 202

St Louis, MO 63127

Follow Us

Bogetto & Associates does not provide legal or tax advice. These topics are discussed in conjunction with your CPA, Tax Advisor and Attorney.

Bogetto & Associates does not provide legal or tax advice. These topics are discussed in conjunction with your CPA, Tax Advisor and Attorney.

No comments:

Post a Comment